Do your qualified plans have:

- A retirement plan consulting agreement?

- A system to evaluate service providers

- An investment policy statement?

- A 408(b)2 notice?

- A digital fiduciary file?

- Fiduciary training for plan sponsors

- A process for benchmarking plans?

- Periodic benchmarking of fees and services

- A program of employee education and communication?

- A process for investment selection monitoring, and replacement?

If not, your clients’ plans

may be at risk

Taking over your clients’ qualified plans is opportunity – and risk. Retirement plans have become a highly technical area of practice.

TAG Retire provides the technical expertise to protect your client (and you) so you can make the most of this business building opportunity.

Most plans (as high as 70%) investigated by the Department of Labor are operationally deficient. Don’t let your client’s plan be one of them!

We build, repair, and improve qualified plans. The TAG Retire team are active qualified plan Advisors on over 1,000 plans with over $2 Billion in assets.

Let us be your plan professionals.

TAG Advisors

in partnership with TAG Retire

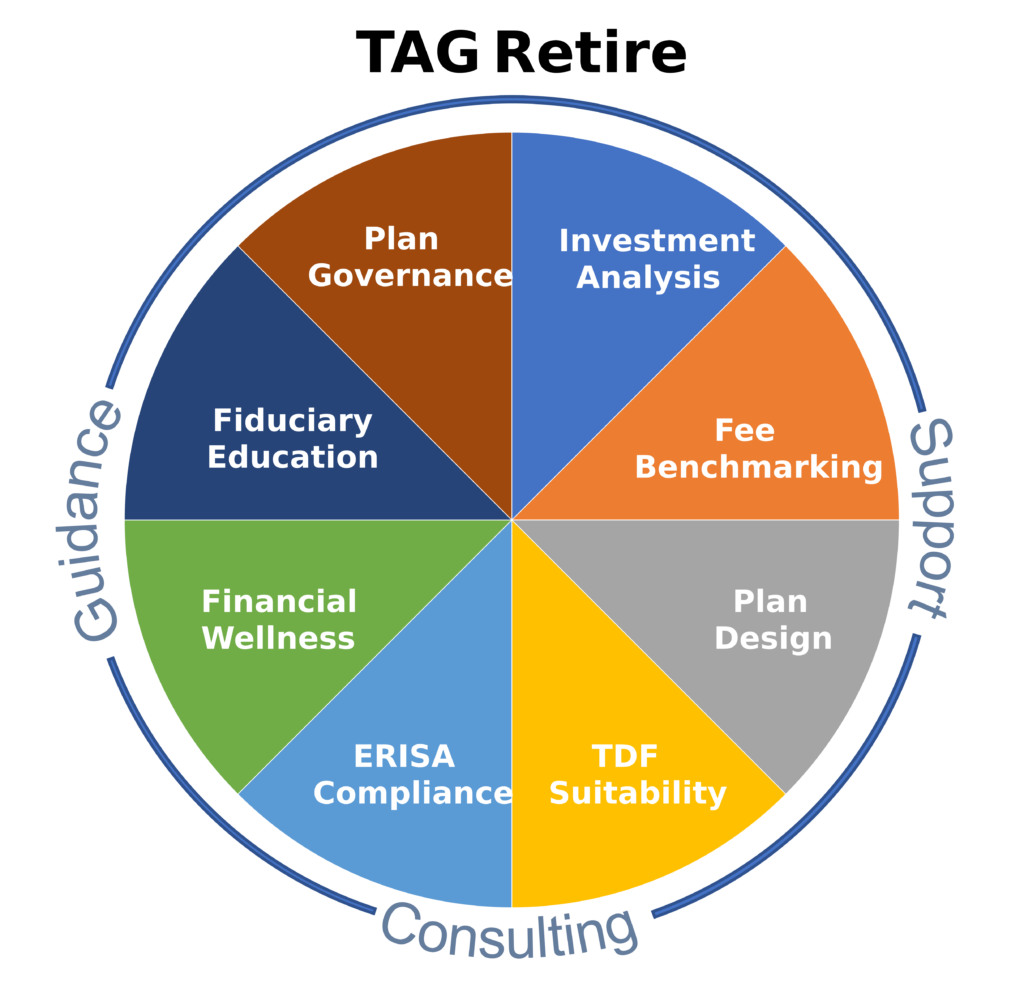

Driven by robust technology, systems and services, TAG Retire has a unique ability

to help create successful retirement plan outcomes for plan sponsors and participants alike.

Want a simple, inexpensive plan solution for small businesses?

Order a Custom TAG(k) Pooled Employer Plan Proposal!

Your qualified plan professionals

Chuck Hammond,

AIF®, PPC®, CMFC®

Director of Qualified Plan Strategy

Chuck is responsible for outreach, education, and marketing as well as support on qualified plans, including vendor selection and monitoring. He is an active retirement plan advisor whose practice manages 26 plans. Hammond is perhaps best known as founder of The 401(k) Study Group, a community of 15,000 financial professionals involved in corporate retirement plans.

Dave Scheetz,

AIF®

Managing Director, Qualified Plans

Dave helps financial professionals build their qualified retirement plan business. He leads the retirement group that manages 950 plans with over $1.7 billion in assets.